Table of Content

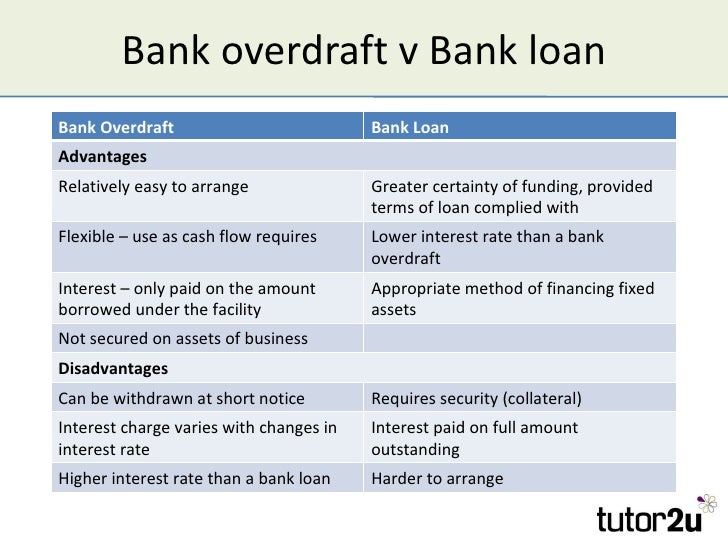

The interest rate you sign on for is the interest rate you’ll pay over the life of the loan. It won’t increase, even when the Federal Reserve raises interest rates. Both a home equity loan and a home equity line of credit put your home up as collateral when borrowing money. However, there are also some key differences between these two financial products.

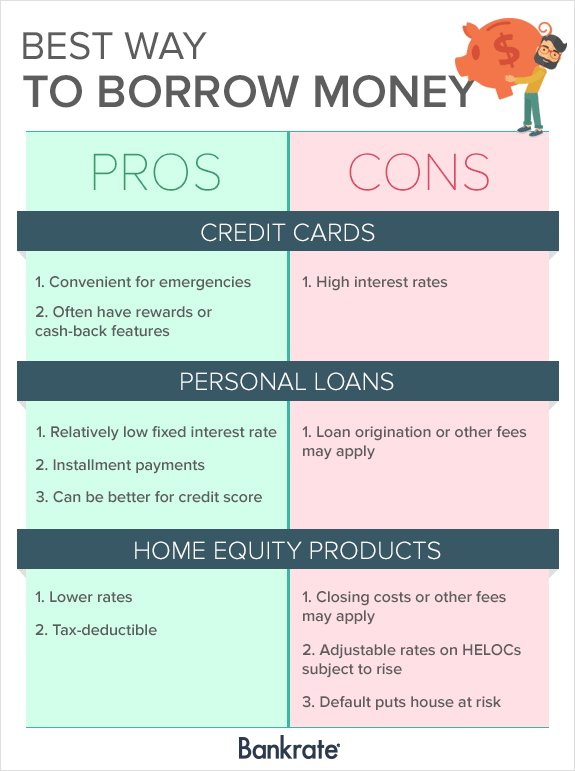

Capstone Capital Markets LLC provides financial advisory services and does not accept deposits, extend credit or engage in trading activity. How important is it for principal owners to maintain complete control of the company? In equity financing, the business owner is selling shares of the company and often retains majority ownership, albeit diluted on a pro rata basis tied to the valuation of the company. The product you choose may depend on your cash needs, the value of your home, your age, your time horizon and other factors. Continue reading for a summary of the pros and cons of each product. Overall, the biggest downside to making a home equity loan is that you are in risk of losing your home if you do not make the repayment amounts as stipulated in the agreement.

Case Study: Capstone Partners Advises UrbanStems on a $20 Million Series C Growth Capital Raise

Another advantage is a fixed interest rate, which means predictable payments. LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace. LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Alternatives to a home equity loan depend on the amount needed and the purpose of the loan. The greatest alternative to a home equity loan is either an emergency fund or delaying an expense and budgeting to save for it in advance, but neither is always possible.

Where home equity loans offer a fixed interest rate that will never change, home equity lines of credit come with variable rates. This means that your rate can go up or down based on the decisions of the Federal Reserve — so even if you take out a HELOC with a low rate, you could face high rates when it comes time to pay. This is especially true in 2022, as the Federal Reserve continues to hike its key rate. The best part about availing of a home equity loan is that the interest rate is usually fixed for the number of years of the repayment of the loan.

Line of credit home loan

The information and products contained on this website do not constitute recommendations or suggestions to purchase or apply for any particular product. Any advice provided on this website is of a general nature and does not take into account your objectives, financial situation or needs. Products included on this site may not suit your personal objectives, financial situation or needs. InfoChoice is not a product issuer or a credit provider and does not provide personal financial advice or credit assistance.

Always be sure to make payments on time, every time, in the appropriate amounts. Otherwise you will lose your home and end up with nothing in the end. With home equity loans, the interest rate can even go lower than what people pay on credit card bills.

Can you get a home equity loan without a mortgage?

A home equity loan is a great way to fund a college education if your lender allows it. While it is the most common way to pay off your education loan, the use can be more beneficial as the home equity mortgage rates are lower than student loan interest rates. If you are looking to fund your children’s post-secondary education, then a home equity loan is the best alternative. Equity financing is a method of raising capital for an organization by selling shares of the organization to investors.

InfoChoice, its directors, officers and/or Representatives do not have any ownership of any financial or credit products or platform providers that would influence us when we provide general advice. We may receive fees and commissions from product providers for services we provide as detailed below. Refinancing your car title loan can work in your favor and sometimes not. Thus, the above-mentioned advantages and disadvantages of it will help you offer some clarity. It is essential to take the right decision that works in your favor.

HELOCs aren’t interest-only forever

Tayne also points out that your monthly payment varies based on how much you’re borrowing, so you can wind up with a smaller monthly payment if you end up needing less cash. Which typically takes place as a consequence of borrowing cash to pay off money owed as well as credit that is not secured that is used by the borrower to buy extra gadgets. When you obtain a home equity loan, even if it is to pay off other debt, you will almost always increase the total amount of debt that you owe.

As with any loan product, shop around to make sure that you’re getting the best deal. With higher interest rates, home equity loans come with higher payments. Her expertise includes mortgages, credit card rewards, and personal finance.

If you have built up equity in your home and want to renovate or buy an investment property, you might consider a home equity loan. It’s flexible to use and repay, provided you can meet the minimum monthly repayments. Interest rates have been at or near all-time lows for a couple of years now, and home equity lines of credit let you take advantage of that fact. Financial attorney Leslie H. Tayne says HELOCs can have lower interest rates and lower initial costs than credit cards. Even after the Tax Cuts and Jobs Act of 2017, you can still deduct interest paid on a home equity line of credit if you use the money for home improvements. The senior professionals in our Equity Capital Advisory Group bring 50+ years of combined experience and have worked on capital formation transactions that exceed $3 billion in aggregate financing value.

Depending on many different factors, a 70 year old homeowner of a home valued at $500,000 could receive as much as $250,000 in cash. This sum would be repaid when the house is sold, and the amount owed will never exceed the value of the house. Downsizing generates efficient cash out of all the equity you have accumulated to date – without additional interest to be paid or debt. Downsizing is widely considered the most efficient way to get money out of your home.

We are an experienced team of mortgage agents and brokers with backgrounds in financial planning, investments & real estate. One of the most common reasons to take out a home equity loan is that the funds can be used to renovate your property. Renovating your home can potentially raise the value of your property which could draw more interest from prospective buyers when you decide to sell it. Furthermore, by taking out a home equity loan for home improvements, you can deduct the interest paid on a home equity loan. If you own a house, you have heard a lot of people talk about the benefits of a home equity loan when it comes to debt consolidation or home improvements. The round was led by SWaN & Legend Venture Partners and DFE Capital Management, with follow-on investments from Motley Fool Ventures, Gordon Segal, Gaingels, PAN, and others.

This allows borrowers to withdraw any amount up to the credit limit designated by the lender. You’ll pay interest only on the amount you borrow, not on the full credit line. Interest is paid at a variable rate during a draw period of typically 10 years. When the draw period ends the interest rate may adjust to a fixed rate and monthly payments will include both principal and interest on the outstanding balance. There are a lot of misconceptions related to refinancing car title loans Fontana. However, refinancing your loan is all about replacing the ongoing loan with a new one.

Benefits of a home equity loan:

It is still secured by your property, but you only borrow funds as needed. This is helpful when you are unsure of the need, such as with a new business or college education. An equity loan is a lump sum distribution, so you have to choose the specific amount to borrow upfront. Not only do you have an additional lien against your property with a home equity loan, but your monthly debt commitment rises. Unlike credit lines, an equity loan is repaid in monthly installments, similar to your first mortgage. This means you owe the installment amount each month until your debt is entirely repaid.

When you take out an equity loan on your home, it usually results in a larger amount of cash available to you all at once. When you borrow through a HELOC, you’re borrowing against home equity you worked hard to build up. If housing prices drop, you could wind up owing more than your home is worth. Having an outstanding HELOC also limits your additional opportunities to borrow from your equity. For the borrower to qualify for a home equity loan, they need to have at least 15 – 20% equity in their property.

No comments:

Post a Comment