Table of Content

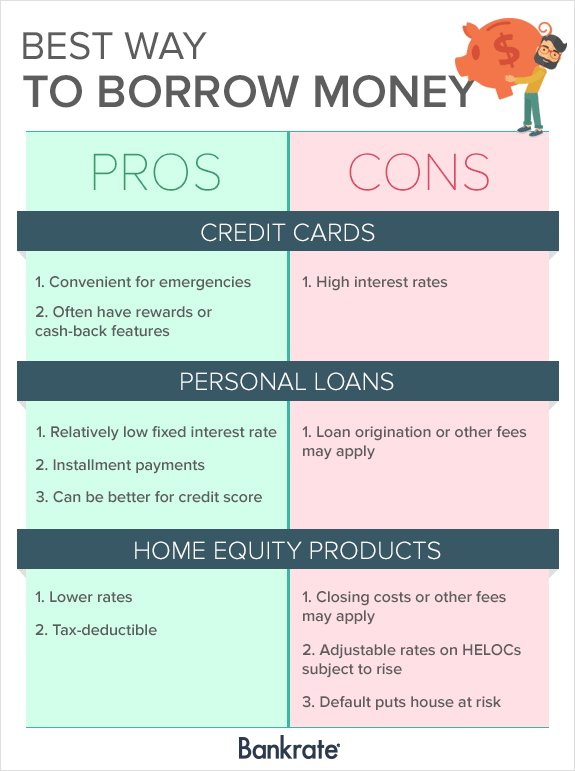

In addition, these buyers may have strong connections in the market that can help form accretive partnerships and establish knowledge-sharing relationships. Private placement investors frequently include angel investors, crowdfunding platforms, venture capital and private equity firms, and corporate investors. Each type of investor possesses distinct qualities that business owners should consider when seeking funding. A disadvantage of home equity loans relative to a home equity line of credit, or HELOC, is less flexibility.

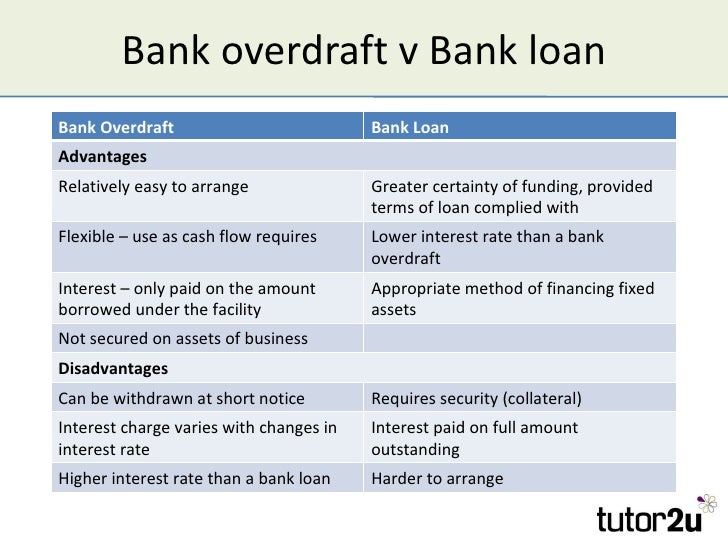

On the other hand, there is also a downside to getting a home equity loan. Because you put your whole home up as collateral, the whole amount that you borrow is a lot more than what you actually might need. This also means that the interest is based on the whole big amount that you borrow rather than on the amount that you actually use. When you refinance into a cash-out loan, you borrow more than you need to mortgage the house and pocket the difference in cash.

Home Equity Loan

If you know exactly how much you need upfront, a home equity loan could be a better option than a HELOC. A home equity loan comes in a lump sum, so if you know exactly how much you need to borrow, it can be the better option. A home equity loan also comes with a fixed interest rate for the life of the loan and fixed monthly payments, which can be a safer bet, particularly in the current environment of rising interest rates. Bankrate.com is an independent, advertising-supported publisher and comparison service.

Our privacy policy describes how your data will be processed. About Us Capstone Partners is among the largest and most active investment banking firms In the United States. A HELOC also offers flexibility in timing the drawdown of your loan amount.

You’re reducing the equity you have in your home

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Companies will often go through several rounds of equity financing as they grow and scale operations, using different equity instruments based on their specific needs. While your home is the place you live, it is also a property investment. Borrowing an additional amount against your equity reduces the net worth of your property asset. This means that if you ever sell your home, you would walk away with less money because you have to pay off two loans. Plus, paying off additional principal and interest each month prevents you from paying down your first loan more quickly.

CU SoCal Home Equity Loans and Lines Of Credit

Or if you want to reduce the payments, you can increase the term of the loan but there will be a slight increase in your interest. A home equity line of credit offers a line of credit you can borrow against when you need to. Like credit cards, HELOCs come with variable interest rates, and for a period of time, your monthly payment will vary depending on your current interest rate and how much you borrow at any given time. As mentioned earlier, a home equity loan can be used to consolidate high-interest debt at a lower rate of interest. Additionally, property owners can use their home equity to pay off other personal debts like a car loan or credit card etc.

Fixed rate loans – the monthly repayment is based on an interest rate that applies for an initial period only and will change when the interest rate reverts to the applicable variable rate. Getting a car title loan in Fontana, CA when you are in a financial crisis or simply want some extra money to start something new has always been a great idea. It helps you financially and this is the smartest deal you can do by offering your car as collateral. But sometimes the situation might turn otherwise and there can be a need for refinancing title car loan.

Financial institutions that offer different interest rates on home equity loans. Make sure to go through all of them to find the best option for you. Also try to consider other types of loans if a home equity loan is something that doesn’t suit your financial needs. Although it is an easy way to get money to pay off loans, or to get a student loan, the borrower might sink even deeper into debt if they take up a second loan to pay off the first. Don’t consider a home equity loan if you are making risky financial decisions.

If you wind up needing less cash than you thought, you’ll have a smaller monthly payment. With a HELOC, you can typically borrow up to 85 percent of your home’s value, minus outstanding mortgage payments, which means that these loans won’t work for borrowers who don’t have considerable equity. You also need good credit to qualify, as well as provable income to repay your loan. If you’re a candidate for a HELOC, here are some of the biggest advantages. Low monthly payments – If the title loan payment is more than your budget then refinancing your car title loan can be beneficial.

As with any loan product, shop around to make sure that you’re getting the best deal. With higher interest rates, home equity loans come with higher payments. Her expertise includes mortgages, credit card rewards, and personal finance.

As a comprehensive financial service provider, the Credit Union of Southern California offers easy home equity loan plans so a shortage of capital doesn’t stand in the way of your financial needs. Many lenders require that you maintain a loan-to-value ratio of 85% or lower, meaning you still have at least 15% equity in your home after borrowing a home equity loan. Because a home equity loan’s interest rate won’t fluctuate with the market, unlike a home equity line of credit , the rate for a home equity loan is typically higher.

Actual repayments will depend on your individual circumstances and interest rate changes. Interest only loans – the monthly repayment figure is applicable only for the interest only period. After the interest only period, your principal and interest repayments will be higher than these repayments.

Tayne also points out that your monthly payment varies based on how much you’re borrowing, so you can wind up with a smaller monthly payment if you end up needing less cash. Which typically takes place as a consequence of borrowing cash to pay off money owed as well as credit that is not secured that is used by the borrower to buy extra gadgets. When you obtain a home equity loan, even if it is to pay off other debt, you will almost always increase the total amount of debt that you owe.

When you take out an equity loan on your home, it usually results in a larger amount of cash available to you all at once. When you borrow through a HELOC, you’re borrowing against home equity you worked hard to build up. If housing prices drop, you could wind up owing more than your home is worth. Having an outstanding HELOC also limits your additional opportunities to borrow from your equity. For the borrower to qualify for a home equity loan, they need to have at least 15 – 20% equity in their property.

No comments:

Post a Comment